Insights

Alert: 2019 Hart-Scott-Rodino Requirements

WHAT YOU NEED TO KNOW

Hart-Scott-Rodino (HSR) filing thresholds will be adjusted upward effective April 3, 2019.

WHAT YOU NEED TO DO

Parties involved in a merger or acquisition should analyze whether it will exceed the new thresholds.

The HSR Act dollar thresholds are adjusted each year. The next set of adjustments will take effect on April 3, 2019. These adjustments may affect whether a company is required to make a premerger notification filing in any given transaction.

By way of background, the HSR Act is designed to provide notice to the federal antitrust enforcement agencies (the Federal Trade Commission and the U.S. Department of Justice Antitrust Division) in advance of large mergers and acquisitions. Where the HSR Act applies, the parties to such a transaction must submit a detailed form, along with copies of certain internal documents and consultant documents accompanied by a filing fee ($45,000, $125,000 or $280,000, depending on the size of the transaction). When Congress passed the HSR Act in 1976, Congress set dollar thresholds for its application, and those dollar amounts stayed frozen for 24 years. Congress then reformed the HSR law in 2000 by increasing the thresholds and by providing that they will be adjusted for changes in the U.S. gross national product.

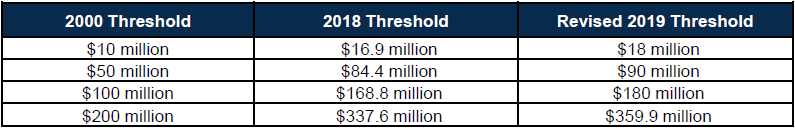

Adjusted Filing Thresholds as of 2019

HSR filing thresholds will be higher in 2019 than in 2018. Some transactions that would have required an HSR filing last year will not require a filing if they close on or after April 3, 2019. Below is a short reference:

By way of brief review, and after giving effect to the 2019 adjustments to the thresholds, in most instances the parties to a transaction must make an HSR filing if:

- One party has a size of at least $180 million (measured by sales or assets);

- The other party has a size of at least $18 million (measured by sales or assets if engaged in manufacturing; by assets, usually, if not engaged in manufacturing); and

- The size of the transaction is at least $90 million.

Regardless of the size of the parties, an HSR filing will be required if the size of the transaction is at least $359.9 million. These figures will be adjusted for changes to the U.S. gross national product again next year.

HSR analysis often involves nuances and detailed rules. The parties should consult counsel early in the planning of any transaction that has the potential to cross these thresholds.